Rather than sharing the report itself this quarter, I thought it would be more useful to share Joe Galvin, Vistage Chief Research Officer, interpretation and perspective as follows.

There will not be a “new normal” on the other side of the COVID-19 crisis. When business activity picks up and the world begins to spin again, people and businesses will engage in a “new reality” that will not resemble what we knew to be normal. We will individually and organizationally engage in new norms defined by fundamentally different societal changes and business dynamics that emerged in the pandemic.

At some date in the not too distant future, there will be a total business reboot — CEOs will be resetting their business in terms of employees, customers and financials — to a new, post COVID-19 level. From that starting point, we will begin to rebuild and grow through the recovery into this new reality.

The transition begins when the current quarantine level of essential services expands to include certain segments of businesses that had been considered non-essential — this will trigger a return to work for many.

The transition will also accelerate as we increase testing, analyze more data and develop better knowledge about the virus. We can expect that manufacturing, construction, business and personal services will reboot first, while bars, restaurants, entertainment and hospitality businesses will reboot later.

Of course, it’s difficult to know exactly when the reboot will happen and when the recovery will begin in earnest. Our April survey of CEOs provides valuable insights into how leaders in our community are feeling about the economy and the state of business.

What CEOs think: April 2020 survey results

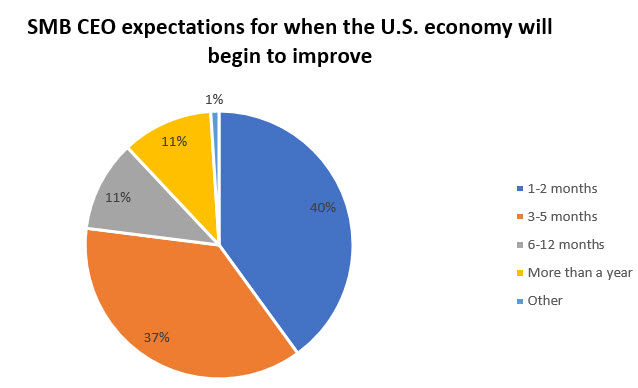

In the Vistage CEO Confidence Index survey conducted April 1 – 8, 11% of CEOs from small and midsize businesses felt that economic conditions would begin to improve in one to two months. An additional 41% thought the economy would improve in three to five months, and another 37% reported it would take six to 12 months.

According to this data, business activity is likely to follow a predictable trajectory: People will return to work in new segments of non-essential businesses, which will ignite the businesses that support them. Once these businesses are in full swing, customers will be encouraged to spend more, resulting in more business activity and the growth of more businesses.

The split in CEO opinions regarding when the economy will improve suggests an economic restart — on local, regional, national and global levels — is still uncertain and will likely take time.

Looking further ahead

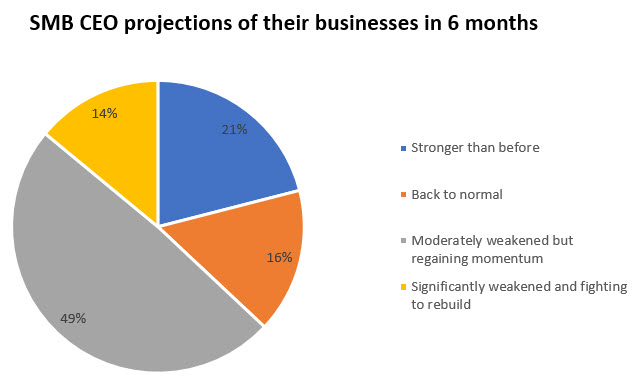

When asked about the state of their businesses in six months, 21% of CEOs felt their businesses would be “stronger than before” and 16% expect it would be “back to normal.” Nearly half (49%) expect their businesses will be “moderately weakened but gaining momentum,” while 14% expect it to be “significantly weakened.”

Should a second wave of the virus hit, these outlooks are likely to worsen dramatically. Much depends on the timing and availability of a vaccine or the realization of herd immunity.

15 years of behavior change in 30 days

The most challenging aspect of any business transformation initiative is human behavior.

Whether it’s the introduction of a new technology initiative or a major shift in culture, transformation is always dragged down by humans’ reluctance to change. Often, this reluctance comes from fears of the unknown or losses in job status.

What’s remarkable is how much the COVID-19 crisis has reduced that resistance. Over 30 days, we saw 15 years’ worth of human behavior change.

This is true in both in personal and professional contexts. Our acceptance and use of technology for digital collaboration, entertainment streaming and the acquisition of food has accelerated as quickly as our individual technology skills have improved. Our acceptance of doing things differently — because we have to — has accelerated our adoption of technology. Technology has allowed much of our lives and businesses to continue in ways that would not have been possible years ago.

Consider these transformations:

Work from home: The genie is out of the bottle on working from home. According to our April survey, 91.8% of CEOs have implemented some form of work-from-home solution during the crisis.

Advances in collaboration applications such as Slack, Zoom, and GoToMeeting, combined with the astonishing performance of internet infrastructure, have made distributed workforces possible. The forced march to digital collaboration has broken down both generational and emotional barriers to this work style. Work from home was already high on the list of preferences for the emerging workforce. It will now become part of everyday life for knowledge workers.

Tele-everything: Practicing social distancing has accelerated tele-capabilities in healthcare, education, business, and more.

- Tele-medicine has enabled doctors to care for a large number of patients, digitally. While not eliminating in-person care, tele-medicine offers a more efficient alternative to traditional medical care.

- Online education has kept students learning and connected to their colleges, universities, and schools while physical buildings remain closed. Many professors and students have already adapted well to digital classrooms.

- Food delivery has ramped up. Beyond ordering takeout, people are placing orders with farms, grocery stores, and local restaurants more than ever before.

- Tele-business will replace the need for physical office spaces. Combined with the work-from-home reality, office workspace requirements will change.

Business travel may never return to prior levels. As businesspeople have learned to connect and communicate digitally, they have also realized that digital communications are just as effective as face-to-face relationships when blended with occasional human contact. Businesses may reconsider how often they schedule face-to-face meetings and may choose to leverage technology for more customer interactions.

No-Touch Transactions: ATMs, airline check-in terminals, and other ‘touch” interfaces will be replaced by a purely digital experience. Apple Pay, QR codes, and Bluetooth will eventually eliminate the need to touch anything minimizing potential exposure. Cash will become obsolete in advanced economies. Credit cards will be replaced and physical tickets of every type will be done digitally, all managed from a “smarter” phone.

Digital transformation: The rapid adoption and utilization of technology will energize digital transformation efforts. As businesses begin to reboot, rebuild and recover, initiatives to digitally transform how business is done will further accelerate, driven by employees’ behavioral changes and newfound flexibility. Lessons learned in the crisis will form the foundation for business change. In turn, this will fuel demand for the 5G network and digital infrastructure to satisfy our ever-greater thirst for bandwidth.

Unanswered questions: The COVID-19 crisis is raising other questions about how business and society may change in the months and years to come.

- Will our collective thinking about healthcare change like our feelings about security did after 9/11?

- Will we think differently about renewable energy after the collapse of the oil market and seeing the skies clear over Los Angeles, Shanghai, and Mumbai?

- After we thank essential workers for keeping us functioning and alive, will we rethink the minimum wage and how we help those most at need in our community?

- Will we think differently about globalization when supply chains and critical components reside outside any country’s influence — and will we think it’s worth the cost to “build our own”?

- What will we think about paying for the cost of stimulus packages on top of an already massive debt?

It only took 30 days to go from what was normal to our current “state of wait.” We continue to look for signs that we can begin rebooting our economy, rebuilding our businesses, and start the climb to a new reality. We will know we’ve arrived when we all feel comfortable going to a sports event, concert, restaurant, theater, or other large social gatherings.

Until that point, be prepared to rethink, reimagine, and relearn everything about the business you knew before the coronavirus — and focus on preparing your business to be one that thrives in the new reality.

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..