Businesses are assets, right? What might happen if we followed the risk management practices of portfolio management in running them?

The “portfolio managers” of our business are our leadership team, our key executives. Business owners have a risk tolerance that leads them to be more or less involved in activities in their businesses.

What I observe as a Vistage chair and leadership coach is sometimes executives frequently feel either micromanaged or adrift and unclear of expectations.

When the business owners abdicate instead of delegate, only to jump back in when things are not going as they expected (but didn’t verbalize), this creates unnecessary risk; leads to outcomes we don’t want and drives everyone crazy.

What if, instead, owners and executives followed the same process as we do for our investment portfolios?

When we hire an advisor to manage our traditional portfolio of stocks and bonds, the first thing they want to know is the answer to the following two questions:

- Will you delegate full responsibility for managing your portfolio to me? or

- Will the account be co-advised? Meaning, before I make a purchase or sale in your portfolio, I must consult with you?

When the owner of the portfolio chooses #1, the client and the advisor work together to design a portfolio that meets the risk tolerance of the client, the advisor constructs the portfolio and typically the advisor provides reports, usually monthly or quarterly, that inform the owner of the status of their portfolio. Additionally, the advisor’s reports include a comparison of their performance to that of their peer group.

Sometimes, the owner of the portfolio chooses #1, but instead of delegating authority, monitoring the performance of the portfolio, and periodically evaluating the portfolio manager; the owner abdicates, i.e. moves on to other things and ignores the portfolio manager.

I heard a sad story from a friend recently who chose option #1, neglected the monitor and evaluation part, and didn’t discover the result until he needed the money and realized it was gone. The advisor was not dishonest, he simply made poor investment choices.

If you decide to try this approach, here are some questions you and your executives might consider asking:

- What decisions will the executive have full responsibility for?

- Which decisions do you want to co-advise?

- What risks are you most concerned about?

- What kind of reporting works best for you? Written, verbal?

- What do you want to monitor, and on what frequency?

- How will my performance be evaluated?

And finally the most important question,

What is our agreement as to how to give each other feedback when the outcomes or the process didn’t go as we expected?

Elisa K. Spain

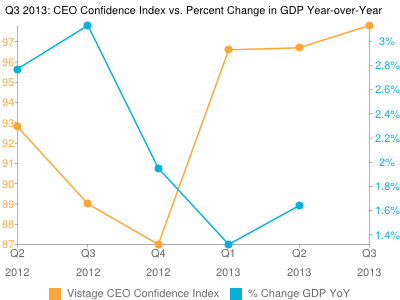

The quarterly Vistage Confidence Index is now available.

The quarterly Vistage Confidence Index is now available.

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..