The quarterly Vistage Confidence Index is now available.

The quarterly Vistage Confidence Index is now available.

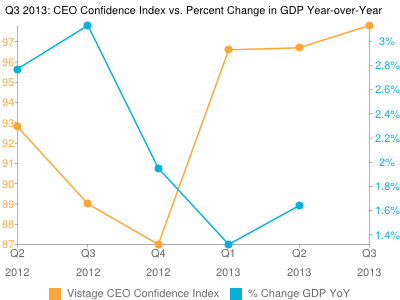

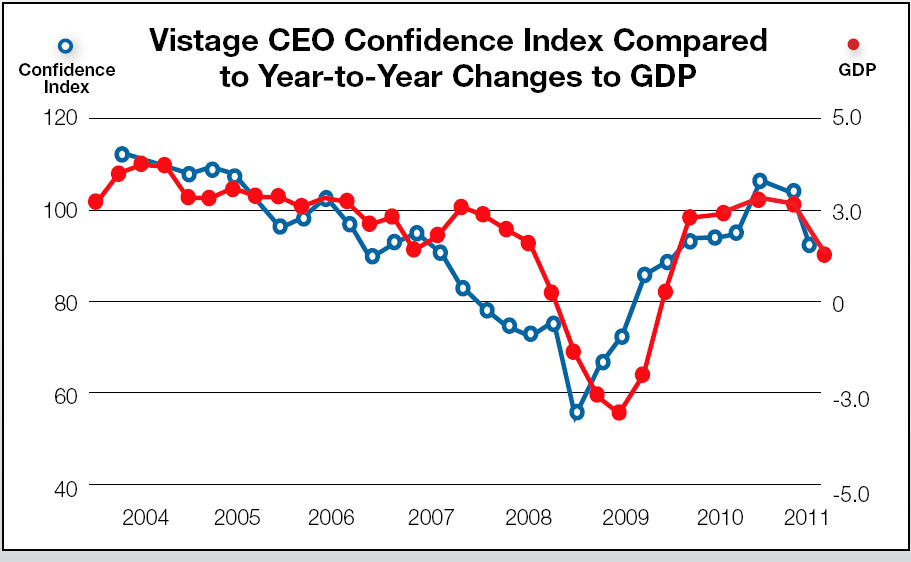

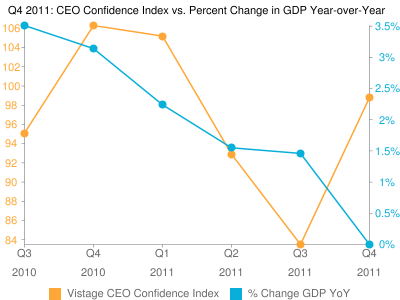

CEOs of small and medium businesses say their overall confidence is down due to a continued slowdown in economic growth and uncertainty over the future of U.S. politics. This is according to the Vistage CEO Confidence Index, which indicated a drop of nearly three percentage points from the second quarter and a 16 percent decrease since March.

Following are key highlights of the survey:

Economic Growth Slows: The continuing decline in optimism has been due to the slowdown in the pace of economic growth that is expected to continue though the start of 2013. Just 27 percent of all firms in the 3rd quarter survey reported that the economy had recently improved, down from 36 percent last quarter and less than half of the 60 percent recorded at the start of 2012. Moreover, the proportion fearing a renewed downturn in the year ahead jumped to 22 percent in the 3rd quarter, up from just 7 percent at the start of 2012. To be sure, the vast majority of firms do not anticipate a recession, but simply a slowdown due to inaction on fiscal policies.

Hiring Plans Remain Favorable: Hiring plans were unchanged from last quarter as half of all firms planned net increases in the number of their employees. Just 9 percent anticipate a net reduction, a clear sign that firms do not expect a downturn. One-in-five firms (19 percent) reported that the payroll tax holiday allowed them to expand their businesses, but fewer firms (12 percent) reported that they would hire more workers if the government offered them a $1,000 tax credit for each new hire.

Investment Plans Slip: Planned investments in new plant and equipment declined slightly, with the percent that planned increases falling to 36 percent in the 3rd quarter from 40 percent last quarter and 45 percent in the 1st quarter. Economic uncertainty has reduced investment plans to their lowest level since the start of 2010.

Revenue Prospects Remain Strong: Two-thirds of all firms anticipated revenue growth during the year ahead in the 3rd quarter survey, unchanged from last quarter. Retaining and attracting new customers was singled out as the biggest challenge by CEOs, with cutting costs their next biggest challenge since the majority of firms expected they could not increase the prices they charged for their products or services.

Stable Profits Expected: Higher profits were anticipated by 52 percent of all firms in the 3rd quarter, barely different from last quarter’s 53 percent but below the 1st quarter’s 60 percent. Although CEOs anticipated an even slower pace of economic growth than last quarter, firms were better prepared to offset the impact of the slowdown on their profits. The 14 percent of firms in the 3rd quarter 2012 survey that expected declines in their profits was slightly below last year’s 15 percent and less than half the peak of 36 percent in the closing quarter of 2008.

Elisa K. Spain

The quarterly Vistage Confidence Index is now available.

The quarterly Vistage Confidence Index is now available.

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..