Publicly held U.S. company governance dictates the requirements for financial reporting and many of these companies give “guidance” as frequently as quarterly. While this approach is sometime criticized as being short-term focused, the important upside is all stakeholders know, at any given time, how the company is performing and can respond accordingly.

Privately held companies, on the other hand, have a choice. There aren’t any governance mandates.

- They can choose to focus on the numbers, or not

- They can choose to report performance to all stakeholders, or not, and

- They can choose to forecast and adjust accordingly or not

Owners sometimes question the need for forecasts and state that sales focus is primary. After all they say, isn’t it all about growth, i.e. how much we sell this year compared to last year?

While most awards for privately held companies focus on top line (Inc. 500/5000, Crain’s Fast Fifty, etc.), in my experience the businesses that follow the following five tenets, are the ones that achieve sustainable growth. And for my Vistage CEO’s it is the reason members voluntarily report their financials quarterly, are accountable to each other for providing guidance, and adjust their actions accordingly.

Five Truths of Profitable GrowthTM

- If you don’t know how you make money, you won’t make money.

- If you don’t set goals for wealth creation, you won’t accumulate wealth.

- Operating budgets and capital budgets are not the same; if you use debt to finance operating expense rather than for growth, you will not grow.

- Top line growth does not equal bottom line growth.

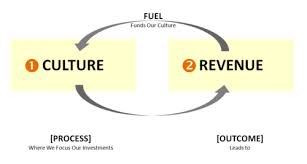

- Without a culture of accountability and measurement, you will underperform.

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..  John Yerger

John Yerger