It’s probably no surprise that the results of last week’s Q3 Vistage CEO survey show a steep drop in confidence among small business leadership.

It’s probably no surprise that the results of last week’s Q3 Vistage CEO survey show a steep drop in confidence among small business leadership.

However, you may also have forgotten that during previous challenging business cycles—including the U.S. Great Depression in the 1930s—many companies prospered. What do you think made the difference?

On Thursday, Vistage International released the results of last month’s survey of U.S. small business CEOs. Not unexpectedly, CEOs foresee a continued slowdown in the pace of economic growth and, amid record-high economic uncertainty, anticipate weak economic conditions to persist during the year ahead.

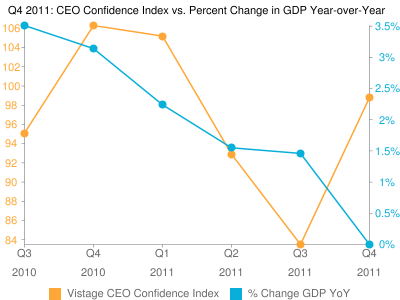

The Q3 Vistage CEO Confidence Index, which surveyed 1,710 US small business executives between September 8th and 19th, was set at 83.5—down from 92.9 in Q2 and substantially below the Q1 index of 105.2. In fact, the 20% decline over the past two quarters brought the Confidence Index to its lowest level in two years.

University of Michigan’s Dr. Richard Curtin, who has directed the survey since 2003, noted, “While firms do not expect an outright recession, they anticipate that the economic growth will be very slow during the year ahead. As a result, they have curtailed investments and hiring, and anticipate smaller growth in profits. And considering that small business has been responsible for 75% of net new job growth in the U.S. over the past 15 years, if the current trend continues, it’s unlikely the employment picture will improve between now and the 2012 election.”

While it’s tough to put a rosy spin on this, haven’t some companies prospered during every economic downturn—even companies that aren’t typically seen as “recession proof?”

Perhaps we should start by asking ourselves some deeper questions:

To what degree is it possible that our beliefs are fueling the current economic situation and the stock market? We know that group and individual psychology play an important role in stock-market fluctuations. Is the broader economy so different?

And even if history reports this period as the second great depression (or the first lingering great recession, or the same stagnation experienced by Japan for the last 20 years, or…),

What if it is the transformation decade? (see blog post The Economic Shift, 9/20/11)

What actions can each of us take—what can we do—to position ourselves to prosper? Today and tomorrow?

To read the full report, go to:

http://www.vistage.com/media-center/confidence-index.aspx

Elisa K. Spain

Tom Searcy is a Vistage speaker who also writes for CBS MoneyWatch. His recent blog titled “7 Tips on How to Apologize in the Business World” resonated for me, so I thought I would share them. Here are the tips:

Tom Searcy is a Vistage speaker who also writes for CBS MoneyWatch. His recent blog titled “7 Tips on How to Apologize in the Business World” resonated for me, so I thought I would share them. Here are the tips:

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..

The initial results of my Pivot are excellent. I feel I have much greater clarity regarding the next 3-5 years..